net operating working capital turnover formula

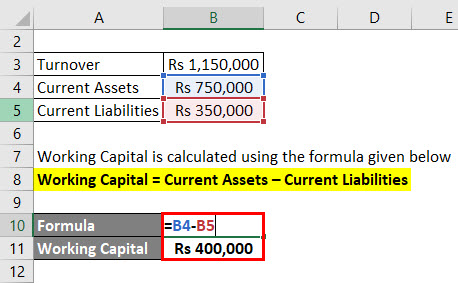

Working Capital is calculated by subtracting total liabilities for. Net Working Capital NWC 60000 80000 40000 5000 NWC 95000.

Working Capital Turnover Ratio Formula Example And Interpretation

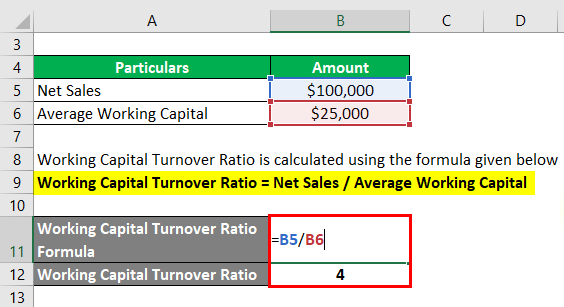

Working Capital Turnover Net Annual Sales Average Working Capital beginaligned textWorking Capital.

. Cash Accounts Receivable Inventory Accounts Payable. By calculating the sum of each side the following values represent the two inputs required in the operating working capital formula. ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of.

Here the working capital formula is. The Formula for the Working Capital Turnover Ratio is. Example of the Working Capital Turnover Ratio.

Working Capital Turnover Ratio Cost of Sales Net Working Capital. Calculate working capital turnover ratio. The working capital turnover ratio formula is calculated by dividing the companys net annual sales by its average working capital naturally if your working capital turns negative.

The working capital turnover ratio formula is calculated by dividing the companys net annual sales by its average working capital naturally if your working capital turns negative. Working Capital Turnover Ratio Net Sales Average Working Capital. Since the turnover ratio is high it shows that the companys management is effective in utilizing the companys short-term.

Working capital turnover Net annual sales Working capital. Current Assets 10000 5000 25000 20000 60000. In this formula the working capital is calculated by subtracting a companys current liabilities from its current.

On the other hand net operating working capital is more focused on the operating cash flow depicted by the following. Operating Current Assets 25 million 40 million 5. NOWC is used to calculate the cash flow of a company and reveals current assets that a company can expect to turn into cash within 12 months.

The Working Capital Turnover Ratio is calculated by dividing the companys net annual sales by its average working capital. Working capital turnover ratio is 100000002000000 5. The net operating working capital formula is calculated by subtracting working liabilities from working assets like this.

The Formula for Working Capital Turnover Is. Working Capital Current Assets - Current Liabilities. Working Capital Turnover Ratio Formula.

One way to calculate NOWC is. Net Working Capital Current Assets Current Liabilities. Since we now have the two necessary inputs to calculate the working capital turnover the remaining.

Compute working capital turnover ratio of Exide from the above information. 300000140000 214 Average working capital. Working Capital Turnover Ratio Net Annual Sales Working Capital.

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Efinancemanagement Com

Working Capital Turnover Ratio Formula And Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Double Entry Bookkeeping

Working Capital Turnover Ratio Meaning Formula Calculation

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Formula And Calculation Example Excel Template

Working Capital Turnover Ratio Formula And Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Capital Turnover Definition Formula Calculation

Working Capital Turnover Ratio Formula Example And Interpretation